Awalé Resources Limited. (TSXV: ARIC) (‘Awalé’ or the ‘Company’) is pleased to announce the results of voting at its annual general and special meeting of shareholders which was held on September 17, 2024, in Toronto, ON (the ‘Meeting’). Full details of all the voting results for the 2024 Meeting are available on SEDAR+ at www.sedarplus.ca. The total number of shares represented by shareholders present in person and by proxy at the Meeting was 29,825,288 representing 34.36% of the Company’s outstanding shares.

All matters presented for approval at the Meeting were duly authorized and approved, as follows:

(i) setting the number of directors at five (5);

(ii) election of the following five director nominees proposed by management: Karl Akueson, Charles Beaudry, Andrew Chubb, Anthony Moreau, and Stephen Stewart;

(iii) reappointment of Davidson & Company LLP as Auditors of the Company and authorization of the directors to fix their remuneration;

(iv) approval, by an ordinary resolution of disinterested shareholders, of certain amendments to the Company’s restricted share unit plan (the ‘Amended RSU Plan’), as more particularly described in the Company’s Information Circular dated August 20, 2024;

(v) approval, by an ordinary resolution of disinterested shareholders, of the Company’s 10% rolling stock option plan, as more particularly described in the Company’s Information Circular dated August 20, 2024.

Stock Options and Share Units

In addition, the Company wishes to announce that it has granted an aggregate 4,055,000 incentive stock options (the ‘Options’) and restricted share units (‘RSUs’) (collectively the ‘Incentives’) to directors, officers, employees, and consultants. The Options are exercisable at a price of $0.45 per share (based on the closing price on September 18, 2024) for a period of 3 years, expiring September 18, 2027. The RSUs have various vesting/issuance schedules. An aggregate 2,720,000 Incentives have been granted to insiders.

Following the award of Options and RSUs, the Company will have an aggregate of 7,551,667 Incentives issued, representing approximately 8.7% of the issued and outstanding share capital.

About Awalé Resources

Awalé is a diligent and systematic mineral exploration company focused on discovering large high-grade gold and copper-gold deposits. The Company currently undertakes exploration activities in the underexplored regions of Côte d’Ivoire. Awalé’s exploration success to date has culminated in a fully funded earn-in joint venture with Newmont Ventures Limited (‘Newmont’), covering one permit and one application (the ‘Odienné Project JV’), within the greater Odienné Copper-Gold Project in the northwest of Côte d’Ivoire, where three gold, gold-copper, and gold-copper-silver-molybdenum discoveries have been made. The Sceptre East and Charger discoveries offer significant potential for growth with future discovery and resource development drilling. The Odienné Project JV has multiple pipeline prospects with similar geochemical signatures to Iron Oxide Copper Gold (IOCG) and intrusive-related mineral systems. The 400 km² of granted tenure and 400 km² under application remain underexplored and present substantial upside potential. The Odienné Project JV forms a solid foundation for the Company to continue exploring in a pro-mining jurisdiction that offers significant potential for district-scale discoveries. The greater Odienné Copper-Gold Project includes an additional four applications and an option agreement.

The Odienné Project JV

The Odienné Project JV covers one permit and one application within the greater Odienné Gold-Copper Project and is subject to an earn-in agreement with Newmont (see May 31, 2022 news release). Through this agreement, Newmont retains the option to earn a minimum 65% interest from Awalé in the Odienné Project JV in exchange for US$15 million in exploration expenditures. Newmont is funding the exploration program while Awalé manages the Odienné Project JV during the initial three-year phase.

AWALÉ Resources Limited

On behalf of the Board of Directors

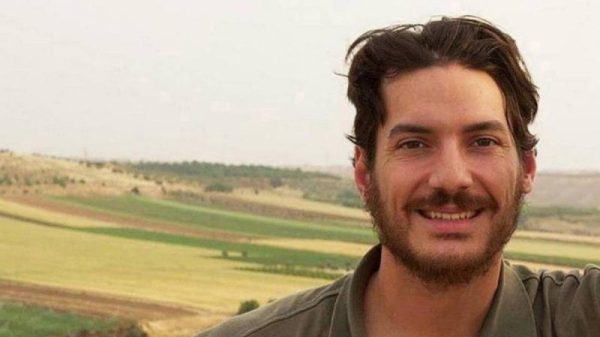

‘Andrew Chubb’

Chief Executive Officer

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

FOR FURTHER INFORMATION, PLEASE CONTACT:

Andrew Chubb, CEO

(+356) 99139117

a.chubb@awaleresources.com

Ardem Keshishian, VP Corporate Development & Investor Relations

+1 (416) 471-5463

a.keshishian@awaleresources.com

The Company’s public documents may be accessed at www.sedarplus.ca. For further information on the Company, please visit our website at www.awaleresources.com.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/223865

News Provided by Newsfile via QuoteMedia