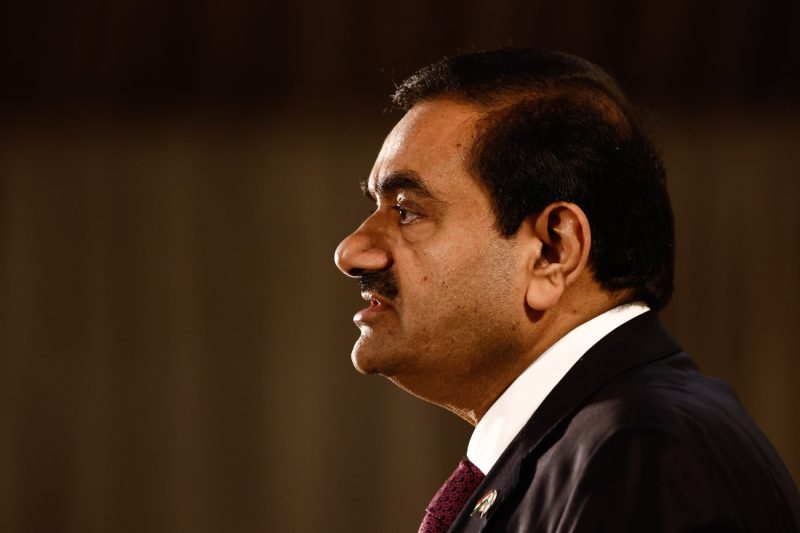

U.S. prosecutors have charged Gautam Adani, India’s second-richest person, with fraud over accusations that he and several alleged co-conspirators sought to pay $250 million in bribes to Indian officials.

The U.S. attorney’s office in Brooklyn, New York, accused the executives, most of them Indian, on Wednesday of obtaining funds from investors in the U.S. and other international lenders “on the basis of false and misleading statements” while, authorities say, they bribed Indian officials as they sought billions in solar power contracts.

“The defendants orchestrated an elaborate scheme to bribe Indian government officials to secure contracts worth billions of dollars,” U.S. Attorney Breon Peace said in a release accompanying the indictment. The defendants then “lied about the bribery scheme as they sought to raise capital from U.S. and international investors,” Peace said.

The scheme, according to prosecutors, occurred from 2020 to this year.

Sagar Adani, Adani’s nephew, is also named as a defendant. The Securities and Exchange Commission separately announced charges of civil fraud Wednesday.

Gautam Adani, 62, who is worth about $70 billion, according to Forbes, heads Adani Group, an industrial conglomerate that holds stakes in logistics and energy units. Adani Group itself is not named in the indictment, which refers to an unnamed “Indian renewable-energy company” that was “a portfolio company of an Indian conglomerate.”

The SEC complaint, meanwhile, directly names Adani Green Energy Ltd., a unit of Adani Group.

In a statement on Thursday, Adani Group denied the allegations, calling them “baseless.”

“The Adani Group has always upheld and is steadfastly committed to maintaining the highest standards of governance, transparency and regulatory compliance across all jurisdictions of its operations,” a spokesperson said in a statement. “We assure our stakeholders, partners and employees that we are a law-abiding organization, fully compliant with all laws.”

The news sent shares of Adani Group companies plunging in India on Thursday, CNBC reported. Its flagship Adani Enterprises fell 23%, while Adani Energy fell 20%. Adani Green Energy, the company at the center of the bribery allegations, was down 18.95%.

Adani Green Energy also canceled plans to sell $600 million in U.S. dollar-denominated bonds.

India’s opposition party has accused Adani of benefiting from his strong ties to Indian Prime Minister Narendra Modi.

“We know that there is going to be no government institution that is going to help put Mr. Adani where he belongs,” Rahul Gandhi, leader of the Indian National Congress, said Thursday. “We know that because the entire government is controlled by the prime minister.”

Last year, a prominent U.S. short-seller, or a firm that bets on the price of another company’s stock to fall, accused Adani Group of fraud, highlighting alleged discrepancies in its official filings.

The findings from the short-seller, Hindenburg Research, caused Adani Group shares to tumble — but they ended up recovering following a favorable ruling related to the allegations by India’s Supreme Court.

Modi never commented publicly on the Hindenburg allegations.

“Since releasing our January 2023 report identifying Adani as the largest corporate con in history, we have never wavered in our view,” Hindenburg said in an emailed statement on Wednesday, “nor has Adani ever refuted our findings.”